how to pay indiana state estimated taxes online

As long as I pay in a combo of estimated taxes and w2 withholding 100 of previous year tax liability or 110 if 150K AGI I should be safe. This way you wont need to pay all your tax at one time when you file.

![]()

Dor 2021 Individual Income Tax Forms

Its essential that the United States ensure that people who come here do so legally.

. Your browser appears to have cookies disabled. But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file. The reality however is that there are currently an estimated 11 million individuals living in the United States without legal status the vast majority of whom are working paying taxes and contributing in both economic and non-economic ways to their community often starting their own businesses.

Cookies are required to use this site. Box 802502 Cincinnati. Pay my tax bill in installments.

If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form. Usually thats enough to take care of your income tax obligations. Take the renters deduction.

Business Personal Property Taxes. Put some money back to ensure you are able to pay your taxes. Have more time to file my taxes and I think I will owe the Department.

Visit the Indiana Department of Workforce Development to learn more about filing for unemployment andor signing up to have Indiana State and county tax withheld. Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation. Business Personal Property Taxes.

Find Indiana tax forms. Your state will also have estimated tax payment rules that may differ from the federal rules. Claim a gambling loss on my Indiana return.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Know when I will receive my tax refund. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business.

Indiana Internal Revenue Service PO. In Maryland there is a tax on business owned personal property which is imposed and collected by the local governments. Find out how to pay estimated tax.

Small Business Administration - Indiana State Agency List Indiana Small Business Development Center Department of Administration - Procurement Division myLocalINgov.

![]()

Dor 2021 Individual Income Tax Forms

Where Do I Find The Worksheet For Filing State Unemployment Insurance Return

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Free Online Paycheck Calculator Calculate Take Home Pay 2022

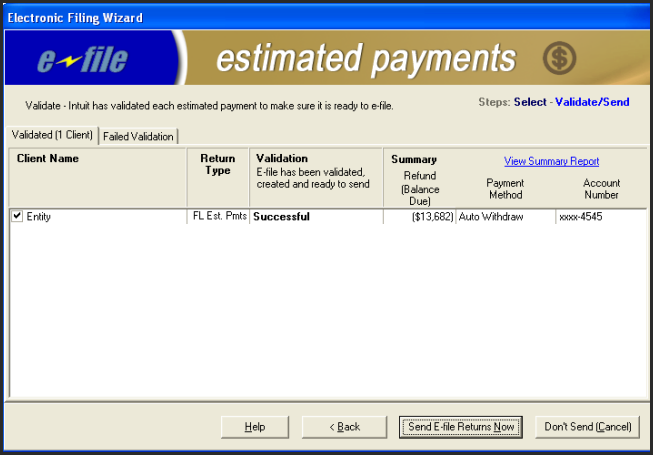

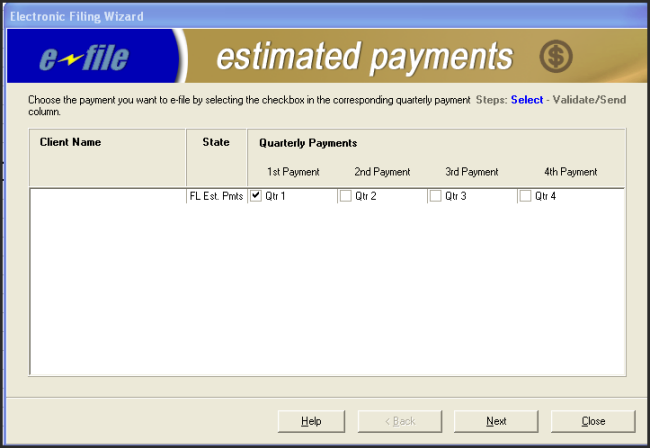

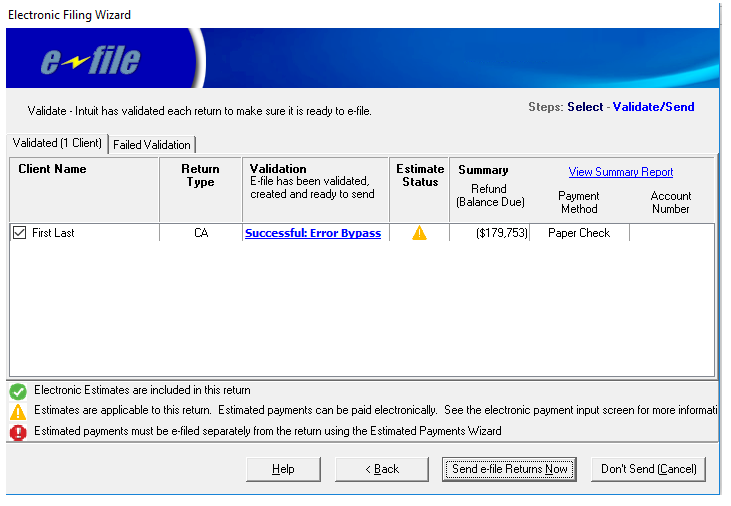

Using The E File Estimated Payment Wizard In Lacerte

Using The E File Estimated Payment Wizard In Lacerte

Tax Calculator Estimate Your Taxes And Refund For Free

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Indiana Sales Tax Information Sales Tax Rates And Deadlines

The Taxation Of Digital Goods Avalara

Using The E File Estimated Payment Wizard In Lacerte

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact