do nonprofits pay taxes in canada

March 29 2017 2 min read. Organizations who qualify for federal tax-exempt status however are also exempt from property taxes according to federal law.

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Do not have a spending requirement.

. Employees collecting a payroll check from a nonprofit or church are just as liable as the rest of us making a living. Many foreign charities ie. Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada Revenue Agency.

By QuickBooks Canada Team. As long as you itemize your deductions you can generally claim 100 percent of your church donations as a deduction. Helping business owners for over 15 years.

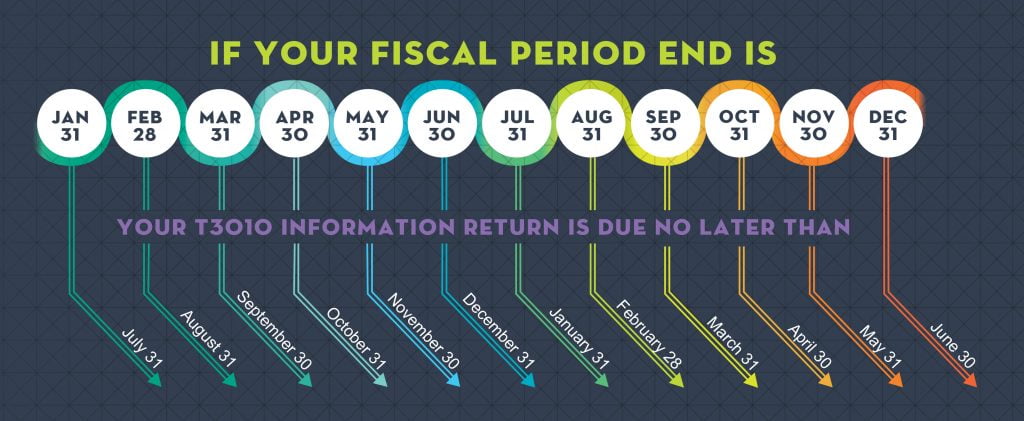

Tax time can be stressful for nonprofit and charitable organizations in Canada especially when the filing requirements are not well understood within the organization. Not-for-profits that are not registered charities may also have to file. All nonprofits are exempt from federal corporate income taxes.

Answer 1 of 3. By contrast an organization that is incorporated under the Canada Business Corporations Act is generally referred to as a business corporation. Nonprofits and churches arent completely off of Uncle Sams hook.

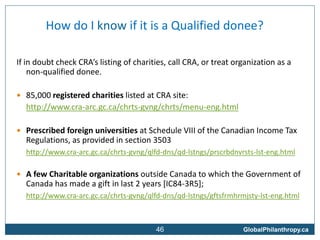

Most are also exempt from state and local property and sales taxes. Iqaluits mayor says he plans to make a motion to remove a land tax exemption for churches in Nunavuts capital city. Canadian federal income tax law distinguishes between non-profit organizations hereinafter NPOs and registered charities hereinafter charities.

Income tax and not-for-profits. Do not have to go through a registration process for income tax purposes self- assessment system. Although nonprofit organizations in Canada do not have to pay income taxes they do have to submit their tax returns with the Canada Revenue Agency.

If your NPO has received or is eligible to receive taxable dividends interest rent or royalties worth more than 10000 you have to file an information return. Additional tax incentives encourage canadians to donate particular types of capital property to. Find more information at About alternate format or by calling 1-800-959-5525.

NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization Information Return. Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada Revenue Agency. Under section 149 of the income tax act ita charities with business operations in canada are.

Do Churches Pay Property Taxes In Canada. Helping Nonprofits Reach New Heights. Not-for-profit corporations are not automatically considered registered charities or non-profit organizations for.

An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act. Nonprofits are of course not exempt from withholding payroll taxes for employees and they also are required to pay taxes on income from activities that are unrelated to their mission. Not-for-profits generally do not pay corporate income tax or file an Ontario corporate tax return but they do have to meet some requirements under Canadas Income Tax ActNot-for-profits that are registered charities must file an income statement annually to the Canada Revenue Agency.

Foreign Charities and Non-Profit Organizations Operating in and from Canada. General Classification The federal tax legislation in Canada makes distinctions among not-for-profit organizations that may be relevant for US. Do Nonprofits Pay Property Taxes In California.

Kenny Bell says he decided to do so after the Cowessess First Nation in Saskatchewan announced Thursday. Non-Canadian charities or non-profits are interested in operating in Canada for numerous reasons including the ability to fundraise and obtain grants to make use of Canadian expertise or to carry on charitable activities. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act.

That means even if your charitys total revenue before expenses from worldwide taxable supplies is more than 50000but your annual gross revenue is less than 250000your organization is considered a small. Do nonprofits pay taxes in canada Saturday March 12 2022 Edit. There are many variations in the requirement for nonprofits to file tax returns based on certain elements such as type of business and financial status.

Charities are required to register for GSTHST when theyre not a small supplier and their annual gross revenue exceeds 250000. This exemption is called welfare exemption in the state of California. Non-profit organization Canada.

Neither exempt from income tax nor from property tax under the Income Tax Act Canada contrary to what appears to be the intention charitable and non-profit organizations often face heavy financial penalties associated with property taxes. CRA Registered charity vs. Since 1945 voters have adopted the Welfare.

There is no requirement provincially federally or within tax law that non-profit organizations have a particular legal form meaning they may be corporations trusts or unincorporated associations. Do not have to file an annual return unless they meet certain criteria. Nonprofit tax filing requirements vary based on the type of organization the value of the organizations assets and other factors.

Our publications and personalized correspondence are available in braille large print e-text or MP3 for those who have a visual impairment. Find more information at About alternate format or by calling 1-800-959-5525. Even though not-for-profits dont pay income tax the requirement to file a tax return has been in place since 1993 and penalties exist.

Rules and requirements for non-profit organizations Few legislative requirements for NPOs in order to receive tax exemption. They must pay payroll tax all sales and use tax and unrelated business income. Even though not-for-profits dont pay income tax the requirement to file a tax return has been in place since 1993 and penalties exist for late filing.

Not only will the employee pay their share of taxes. Non-profit organizations whose primary purpose and operation is related to the promotion of amateur athletics in Canada is exempted from this rule. GSTHST Information for Non-Profit Organizations.

Charities and not-for-profits ought to ask themselves whether property taxes apply to. This guide is for you if you represent an organization that is. Taxes Nonprofits DO Pay.

How To Start A 501c3 Ultimate Guide To Registering A 501c3 Nonprofit Doctors Note Template Doctors Note 501c3

Rules Of Engagement The Nonprofit Vote

Simple Ways To Start A Nonprofit In Canada With Pictures

Canadian Nonprofits Make Tax Receipts Compliant With Canada Revenue Agency S Regulations Nonprofit Blog

How Do Non Profits Make Money In Canada Ictsd Org

15 Best Countries For Giving Back According To Good Country Index Canadian Call Centre Ivr Web Chat And E Mail Response Solutions Cool Countries Country Best Cities

Maine Budget Proposal Includes Controversial Tax Changes For Large Nonprofits Canadian Call Centre Ivr Web Chat And E Mail Response Solutions Fun Fundraisers Nonprofit Fundraising Non Profit

Fundraising From Canada An Introduction For Uk Charities By Mark Bl

Is A Non Profit Organization A Charity Canada Ictsd Org

Simple Ways To Start A Nonprofit In Canada With Pictures

Don Nonprofit Organization In Canada Have A Tax Id Ictsd Org

Do Nonprofit Organizations Pay Taxes In Canada Ictsd Org

Do Nonprofits Pay Taxes In Canada Ictsd Org

Do Nonprofits Register For A Tax Id In Canada Ictsd Org

Canada S Nonprofit Sector In Economic Terms

Do Nonprofit Organizations Pay Property Taxes In Canada Ictsd Org

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)